If you’re a homeowner in Eastern North Carolina, including Beaufort, Morehead City, and Atlantic Beach, you may be eligible for tax credits under the Inflation Reduction Act. The act provides incentives for homeowners who make energy-efficient upgrades to their HVAC systems, which can help reduce energy consumption and lower utility bills.

In this article, we’ll discuss the benefits of the Inflation Reduction Act tax credits and how to take advantage of them for your HVAC needs.

The Benefits of the Inflation Reduction Act Tax Credits

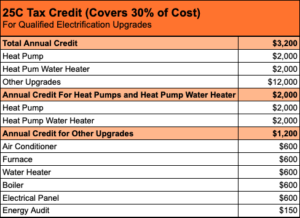

The Inflation Reduction Act provides a tax credit for qualified HVAC equipment, including air conditioners, heat pumps, and furnaces. To qualify for the tax credit, your new HVAC equipment must meet specific energy efficiency standards set by the federal government.

By upgrading your HVAC system to meet these standards, you can receive a tax credit and save money on your energy bills in the long run. Newer, more efficient equipment uses less energy to heat and cool your home, which can lead to significant savings over time.

In addition to the financial benefits, upgrading your HVAC system can also improve your indoor air quality and overall comfort. Newer systems often have advanced features like air purifiers and humidity control, which can help reduce allergens and improve respiratory health.

How to Take Advantage of the Inflation Reduction Act Tax Credits

To take advantage of the Inflation Reduction Act tax credits, you’ll need to follow these steps:

Find a Reputable HVAC Contractor

To upgrade your HVAC system, you’ll need to work with a reputable HVAC contractor like Coastal Home Services who can help you select the right equipment for your home and ensure that it meets the necessary energy efficiency standards to qualify for the tax credit.

When selecting an HVAC contractor, be sure to read online reviews, check their credentials and certifications, and ask for references from past clients.

Choose Energy-Efficient HVAC Equipment

To qualify for the tax credit, your new HVAC equipment must meet specific energy efficiency standards set by the federal government. Your HVAC contractor can help you select the right equipment for your home and ensure that it meets these standards.

Claim the Tax Credit on Your Taxes

To claim the tax credit on your taxes, you’ll need to file IRS Form 5695 along with your tax return. Your HVAC contractor can provide you with the necessary documentation to claim the credit, including the Manufacturer Certification Statement and the Energy Star label.

The HEEHRA and HOMES Rebate

Two different rebate programs offer savings to homeowners who make energy-efficient upgrades to their homes: the High-Efficiency Electric Home Rebate (HEEHRA) and the Homeowner Energy Efficiency Rebate Program (HOMES Rebate).

HEEHRA provides up to $14,000 in rebates to low and middle-income homeowners who make eligible upgrades. The rebate covers 100% of the costs of professional electrical services, equipment, and installation for low-income homeowners, and 50% for middle-income homeowners.

On the other hand, HOMES Rebate offers cash-back rebates ranging from $2000 to $8000 to homeowners who make energy-efficient upgrades that significantly reduce total energy output. Although homeowners in all tax brackets can save money with the HOMES Rebate, low and middle-income homeowners are eligible for the highest rebates.

Conclusion

Upgrading your HVAC system to meet the energy efficiency standards set by the Inflation Reduction Act can provide significant financial and health benefits for homeowners in Eastern North Carolina, including Beaufort, Morehead City, and Atlantic Beach.

By working with Coastal Home Services, you can take advantage of this opportunity to improve your home’s comfort, indoor air quality, and energy efficiency while saving money on your utility bills. We can help you choose energy-efficient equipment and claim your tax credit.

Use the form below to contact us about how you can save money on energy-efficient upgrades to your home.